Looking for a more flexible way to pay your workers? Confused by the different payment solutions? Don’t be. In this article, we’ll explain the difference between On-Demand Pay, Earned Wage Access and Instant Payments.

For decades, we’ve never questioned the pay cycle - it’s simply accepted that workers are paid once a month. But, thanks to advances in technology, it no longer needs to be that way.

Businesses can choose to pay at a cadence that best suits them and their workers - even giving access to earnings after each shift. Providing this kind of flexibility when it comes to payments can have benefits for everyone.

Benefits of flexible payments for companies employing frontline workers

For companies that employ shift or gig workers, switching to flexible payments can help you become a more desirable business to work for. When workers don’t have to wait to get paid, they’re more incentivised to pick up shifts. Fast payment also helps to drive loyalty, creating a workforce that feels positive about your company.

Meanwhile, there are operational benefits too because moving to flexible payments through a platform like Onsi can reduce admin. You can ditch laborious payroll spreadsheets and streamline payment management via our platform integrations. It’s fast and simple to get set up - we even provide the funds so you can get started with no significant changes to your cashflow.

Benefits of flexible payments for frontline workers

Being able to access your wages as soon as you’ve earned them is good for anyone, but especially for frontline workers. Shift and gig workers often work variable hours to fit around their other commitments (it also depends on the work available to them). Flexible payments can help them to manage their cashflow from one week to the next.

Flexible payments also mean workers always have access to money when unexpected events or expenses come up. This can go a long way to alleviating the financial anxiety that frontline workers experience, and dramatically improve their wellbeing.

The different types of flexible payment solutions

Now you know the benefits of paying your workers flexibly, let’s take a look at the different options for doing so, and some of the terminology you may come across as you research providers…

What is On-Demand Pay?

On-Demand Pay is exactly what it sounds like - pay for the worker whenever they want it. When a worker has completed a shift they get immediate access to their wages. They can choose to draw the money down straight away, or let it build and withdraw it at the end of the week, or in a fortnight - most importantly, the choice is theirs.

When a worker chooses to withdraw money, they pay a small transaction fee to have it transferred to a bank account of their choice. However, the business can opt to cover this fee, providing workers with an added benefit.

What is Earned Wage Access?

Earned Wage Access (EWA) is a way for employees to access a percentage of their accrued wages before the end of the current payroll cycle. Businesses can decide when workers can access their earnings - perhaps letting them dip in mid month or at the end of each week.

Like On-Demand Pay, EWA usually requires the employee to pay a fee to withdraw their wages before the traditional ‘payday’. Although businesses sometimes absorb it as a cost of employment. EWA can also be referred to as wage advance, early wage access, and salary advance.

What are Instant Payments?

Instant Payments are another benefit designed to incentivise shift and gig workers. They allow businesses to pay workers instant bonuses. This might be for picking up an unpopular or one-off shift or it could be a reward to recognise their work.

With Onsi, businesses can build tiers that let workers access bonuses and benefits as they hit certain milestones. By gamifying worker pay, this gives a win-win situation for both the business and the worker. Incentivising the worker to take more shifts for better access to pay and other benefits, whilst the business having a steady stream of reliable, engaged workers.

Easy management of flexible payments through the Onsi App and platform

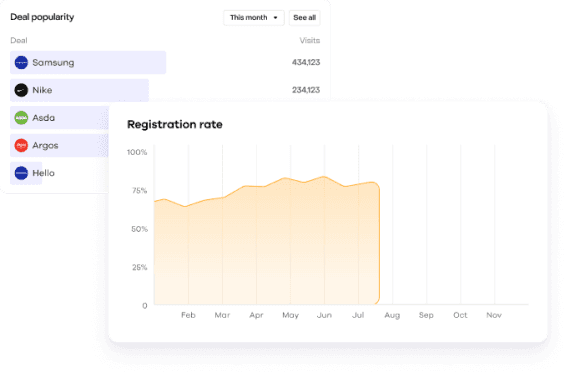

The Onsi App gives workers complete control over their earnings. They can see how much they’ve earned for a shift or job, and receive instant notifications of bonuses or tips received. Workers can also see any discount vouchers they have purchased, and how much they have saved.

Meanwhile, the Onsi platform offers the business complete oversight of redeemed payments, and shows you how benefits are being used. You can give different benefits based on shift data and tweak rewards in real time to drive business performance.

Conclusion

In a world where you can stream the latest movies and order goods for same-day delivery, flexible payment solutions makes sense. Why should workers wait weeks to get paid?

Businesses that want to position themselves as modern, and make themselves attractive to younger workers need to adopt new payment tech now. Speak to one of our team to learn how Onsi can help you make the transition.