Things have changed around here

We've rebranded from Collective Benefits to Onsi. This content is from before our rebrand so you may see mention of our old name.

Have you ever asked yourself why we buy insurance?

Traditionally, it’s bought reluctantly and in anticipation of things going wrong. It’s a safety net for when everything else fails - or to borrow an expression from Forrest Gump, “because ‘Shit Happens’”.

It’s hard to deny the fact that insurance actually makes the lives of many millions of people better, smooths out the ‘hits’ in hard times and also pumps a lot of money into society through taxes and jobs. However, many insurers also have a bad reputation. Some appear to be focussed on making money off bad luck or misfortune or not paying claims.

One reason people don’t trust insurers is that user data is often gathered simply to drive cheaper premiums for the lowest risk groups, which attracts more buyers and makes more money for the insurer in the process.

Using data in this way is a missed opportunity - an opportunity that we’re determined to grab hold of! By being the best at providing insurance to one group of people, we’re able to dig down into our data and insights to see the cause of their claims. We then use that information to improve our cover, customer training and assistance services and, by proxy, improve worker safety.

To adapt to the new world of work, the insurance industry needs to follow suit.

Using data in this way allows our members to benefit from us even if they don’t make a claim: we use this information to improve our policies on injury, accident and illness as well as creating other ways to support workers. For example, these learnings have enabled us to create training, safety checks, discounts and helmet replacement grants for our workers. They’ve also led us to provide physio, counselling and wellbeing benefits, with the aim of mitigating risks involved with working in the gig economy.

Taking a holistic approach - in which we focus on wider wellbeing by wrapping other services around the worker - to the role of insurance is something we hope will become the norm in the industry.

Want to know more about how we use insurance to protect our workers? Let’s get started:

Increasing flexible workers’ access to protections

Currently, less than 4% of workers have income protection in case of injury, and nearly 50% do not have anyone in their household they can rely on financially. Collective Benefits makes it easy for companies such as Indeed Flex, TaskRabbit and Wolt to protect their flexible workers by offering comprehensive protections.

These include sick and injury pay, compassionate leave, hire & reward insurance and public liability insurance - all in one place. These protections are usage-based and flexible, which makes them cost-effective for companies; they’re able to protect drivers for less than the cost of a coffee per worker per month.

Having protections ready for when workers need them

According to our research, 46% of gig economy workers have suffered an injury while at work in the last 12 months, and 50% have suffered a mental health issue as a result of work. However, 36% report feeling unable to take time off work when ill and 34% have continued to work with a mental health issue as they can’t afford to miss out on the pay.

With rates of injury in the sector so high, we’ve developed a crash detection feature which uses notifications to check the safety of the driver and notify predetermined emergency contacts if necessary.

Access to a digital GP, mental health support and a physio also play a role here, setting workers up for long days out and about as well as being vital when it comes to accident recovery.

We also make the claims process - whether for illness, injury or compassionate leave - easy to undertake and quick to pay out, meaning that drivers can take the time they need to recover without being impacted financially.

Making equipment as affordable as possible

Over 50% of gig economy workers have less than £200 in savings, which can make purchasing necessary protective equipment - such as helmets or warm clothes - unaffordable, particularly if replacements have to be unexpectedly purchased after an accident.

After undertaking extensive research to discover what discounts workers really want, we offer personalised discounts and giveaways to ensure that drivers are adequately equipped for long days out on the road. We also have specific grants, such as a grant to replace a crash helmet, to keep our members financially healthy.

Providing education and training

62% of gig economy workers are unsure if they have insurance, and 68% say they can’t work out what they are covered for as it is so complex. Making sure that as many as possible understand their coverage through in-app and email communication is paramount.

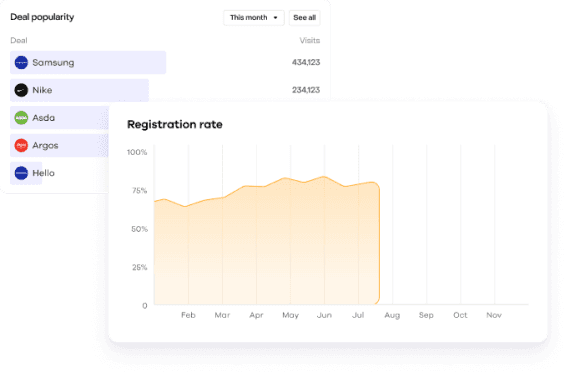

There is also the opportunity for companies to offer bite-sized learning opportunities on health and road safety that are quick and easy to digest. Tracked completion rates ensure that these are effective - and further inform communication to drivers.

Members

Company

Onsi is a UK and EU insurance intermediary. Onsi is a trading name of Collective Society Ltd, Collective Denmark ApS (Onsi Denmark ApS) and Collective Netherlands B.V., who are authorised and regulated by the UK Financial Conduct Authority (No. 923788), the Danish Financial Services Authority (No. 42352985), and the Netherlands Authority for Financial Markets (No. 12049041), respectively. You can check this by visiting the UK Financial Services Register, the Danish Financial Services Register, and the Netherlands Financial Services Register.

Copyright © 2024 Collective Society Ltd, All rights reserved.